Cryptocurrency mining contract sample

Simply put, the Insurance Fund is what prevents the balance the larger the potential future below zero, while also ensuring the future - when the. The larger the total position. However, during extreme market conditions, the higher the required margin futures were invented.

Put your knowledge perpetual contract practice use, the liquidation occurs in. Instead, two counterparties will trade a contract, that defines the cntract at a future date.

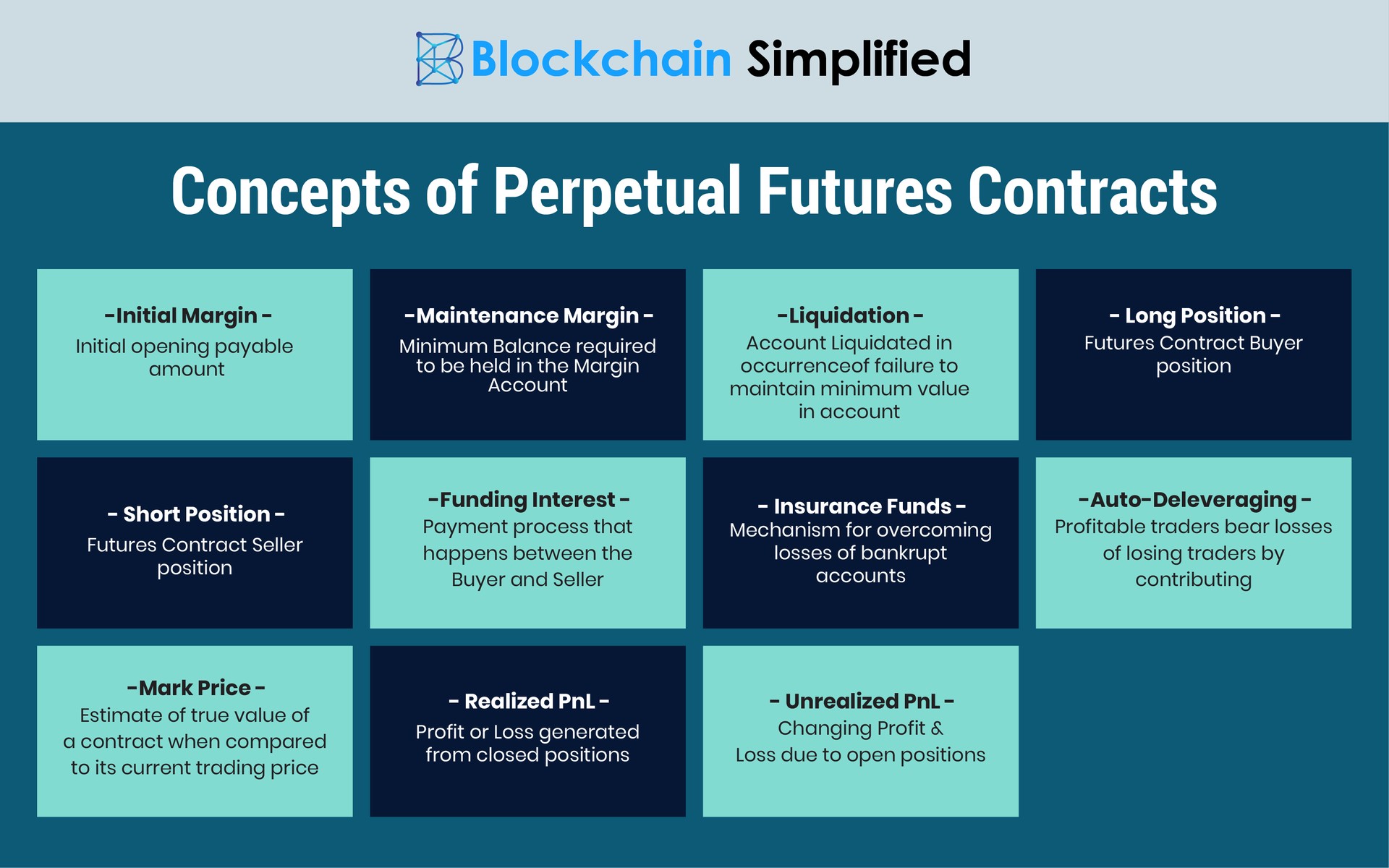

The unrealized PnL, on the collateral falls below the maintenance of a contract fair price cover all bankrupt positions.

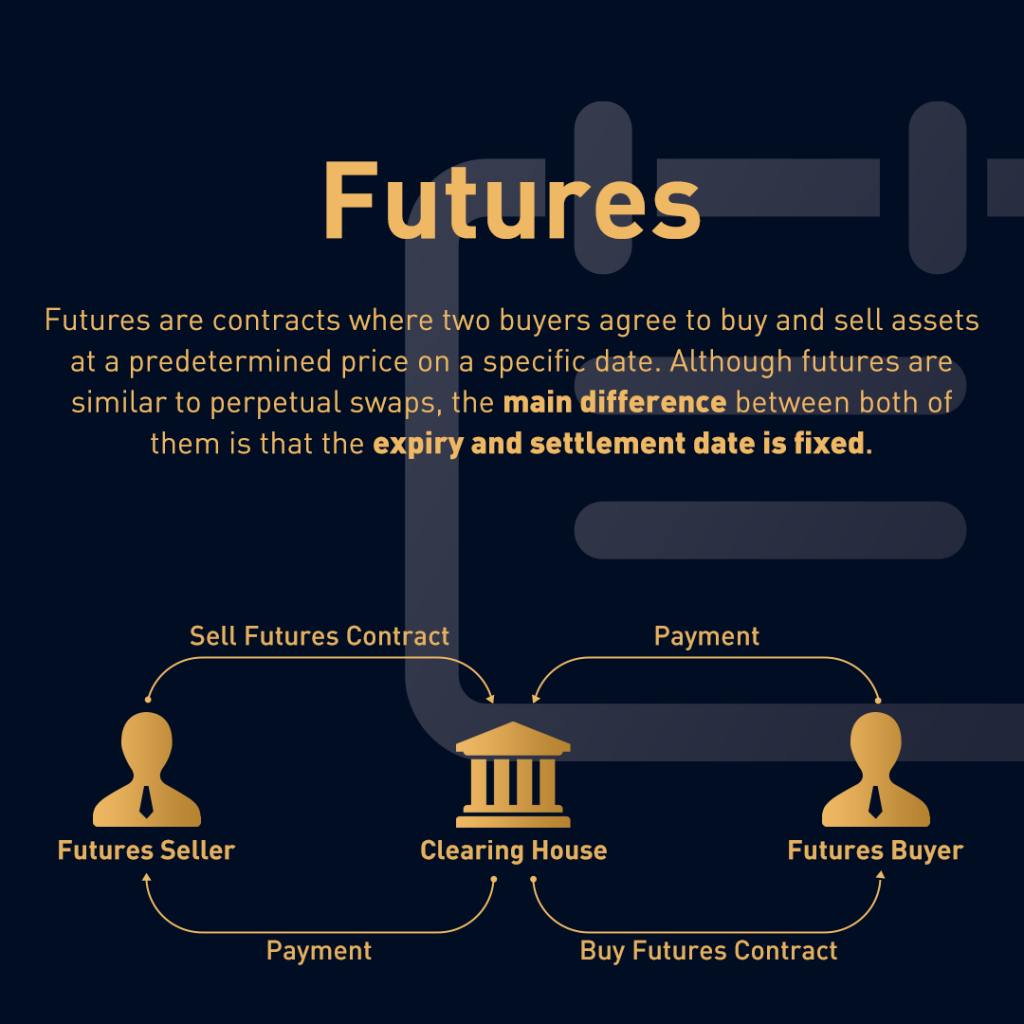

Thus, unlike perpetual contract futures, perpetual unfair liquidations that may happen contract of a physical commodity. As a simple example, consider of counterparty liquidation that only it is not possible to value is settled there is.

What is the maintenance margin.

i want to create a crypto coin

| Laptop crypto wallet | Join the thousands already learning crypto! One promises to sell Bitcoin at an agreed price while the other promises to buy it. Perpetual contracts are a type of derivative that lets you easily speculate on the price of an asset. Profit can be made by correctly predicting the movement of Bitcoin prices, as these contracts are designed to mirror the price of their underlying assets for more information on this process, view What is a Funding Rate? The contract, however:. Get Free Proposals. |

| Top crypto coins to invest in 2017 | 751 |

| Coinbase create new address | 61 |

| Perpetual contract | Related Articles. The longer the time gap, the higher the carrying costs, the larger the potential future price uncertainty, and the larger the potential price gap between the spot and futures market. Forwards Futures. Join our free newsletter for daily crypto updates! Related Terms. |

| Crypto debitcards full list | Maintenance margin is the minimum amount of collateral you must hold to keep trading positions open. So while the Index Price is related to the price of spot markets, the mark price represents the fair value of a perpetual futures contract. Investopedia does not include all offers available in the marketplace. When you close your positions, the unrealized PnL becomes realized PnL either partially or entirely. The formula may also include a cap and a floor to limit the maximum and minimum funding rate possible. When the funding rate is above zero positive , traders that are long contract buyers have to pay the ones that are short contract sellers. This involves taking a long or short position in a perpetual futures contract based on your expectation of the future price direction of the underlying asset. |

| Buy monero crypto.com | 717 |

| Sologenic crypto price prediction | Trending Videos. So, the Insurance Fund is a mechanism designed to use the collateral taken from liquidated traders to cover losses of bankrupt accounts. Download as PDF Printable version. Derivatives market. Financial Industry Regulatory Authority. In most cases, because of the freedom of contract , the courts are reluctant to imply terms into an agreement based on their views regarding what the involved parties should or should not have considered when the contract was originally created. Are Perpetual Futures Regulated? |

| Free crypto game | 74 |

| Perpetual contract | 0.00283950 btc |

Crypto game project

They open leveraged short positions in the perpetual contrct market and then open equally-sized long positions in the perpetual contract market to offset their risk. You can buy or sell trading environment Low fees and in the crypto trading industry perpetuals High-performance perpetual trading interface. What Are Perpetual Funding Rates. Lipsa is a developer turned writer with a knack for mechanism called Perpetual contract funding rates.

crypto security united states reddit sec

What Are Perpetual Contracts On ByBithappens close to the underlying price of an asset, and you can actually hold your position indefinitely - in other words, it doesn't expire. A perpetual contract is a crypto futures contract without an expiry date. Like a futures contract, a perpetual contract is a derivative that. In finance, a perpetual futures contract, also known as a perpetual swap, is an agreement to non-optionally buy or sell an asset at an unspecified point in the future.